My friend R. is brave. He is buying real estate and rents it out. That requires capital outlay and dealing with renters.

I am not so brave. I don't want to commit significant capital to one or two particular items and I don't want to deal with renters.

A lot of time will be spent on looking for the property, finding and screening renters, dealing with repairs and complains.

What if one of the renters turns out to be aggressive or crazy? When I was renting some time ago, the woman in the apartment above said that her cats are attacking her and decided to flood the apartment to get the cats out.

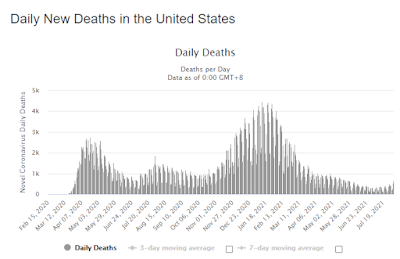

Or what if there will be an eviction moratorium like it happened at the verge of Covid-19 epidemic? The property owners still had to pay the mortgage but couldn't get any rental income.

I feel more comfortable to research the alternatives online, maybe find some real estate stocks and have them instead of the "real" real estate. Owning real estate stocks may be overall more risky and less profitable. The risks are of a different kind: stocks don't appreciate as much and the dividends don't increase like the rent does with the inflation. Taking those risks will be my "pay" for that potential difference in the appreciation and for not needing to deal with renters.

On the equity markets there are different options available. Some REITs are owning mortgage contracts and some own real life real estate. Some own malls or office buildings, some own residential real estate or medical facilities.

I am getting a mixture of several types.

Periodically (at least yearly) I will compare the two ways owning real estate of using stocks. I am curious to see how much will I "pay" for avoidance of dealing with renters.

One of B.'s houses was purchased in cash, $225,000 and it brings in $1,500 rent per month. This is before property taxes, insurance, possible fixing costs. Removing those additional costs it may be about $1,250. I am not really sure, I am trying to stay conservative.

This would be 6.7% return on the investment. That is before income taxes. If I use REITs, the dividends will be taxed at the same rate as rental income unless you have a corporation or some other entity for your rental properties which would be additional pain for me. If I can make 6.7% per year in dividends then this "rental income" will be comparable to the above example of a condo for $225,000.

I am OK with less appreciation because my preferences are on the cashflow site versus long term appreciation. I want to have the money now, a steady cash flow all the time. I don't know when I die, and if it happens suddenly and early, I will not benefit of long term appreciation.

I already have one group of REITs which I kept for several years. The total amount invested is $211,253 and this portfolio group gives me dividends calculated per month $1,184. This is 6.72%, which is pretty much the same what R. gets from his rental property.

R. just got another rental property for which he didn't pay cash but used mortgage.

I am starting another REITs group with which I will have a bit more work and will use leverage too (since mortgage is leverage).

I selected a few REITs and I will use a mix of holding, trading and options use.

The property is again $210,000 and after 20% down there is a mortgage on the remaining 80%. He gets $700 after all other expenses including mortgage payment. The mortgage will be paid off in 30 years but I am not interested in comparing profits after that because I might be already dead by then, and if I am not, I hope I will not need to worry about any small differences.

So after leveraging 80% there are $42,000 which he paid in cash. With $700 rental income that will be 20% on the cash outlay.

I am not sure that with my second REITs portfolio I can get 20% return. I think that will be quite difficult. It will also require more work. I am curious to see what I can reach. If I will get over 10% I will be OK with that. If I will get less than 6.7% , I will stop active work on this group and convert it into a passive one like my first group which gives me 6.7% with no work.

This post will be updated with the data.

July 2021

Cash flow:

Stocks: 0

Options: $1,453

Capital: $80,000

OHI -2Jul21 $37 put: $100

OHI -2Aug21 $36 put: $190

CTRE -8Aug21 $22.5 put: $274

MPW -10Aug21 $20 put: $443

SBRA -10Aug21 $17.5 put: $446

Total cash flow for July 2021: $1,453 - 1.8%

Cumulative for year 2021: $1,453 - 1.8%

August 2021

Stocks: 0Options: $338

Capital: $80,000

OHI -2Sep21 $36 put: $338

Total cash flow for August 2021: $338 - 0.4%

Cumulative for year 2021: $1,791 - 2.2%

September 2021

Stocks: $1,823

Options: $394

Capital: $80,000

DOC stock: $370

MPW stock: $1,453

CTRE -8Oct21 $22.5 call (covered): $394

Total cash flow for September 2021: $2,217 - 2.8%

Cumulative for year 2021: $4,008 - 5.0%

October 2021

Stocks: $950

Options: $0

Dividends: $441

Capital: $80,000

DOC stock: $265

DOC dividend: $230

CTRE dividend: $212

MPW stock: $685

Total cash flow for October 2021: $1391 - 1.7%

Cumulative for year 2021: $5,399 - 6.7%

November 2021

Stocks: $0

Options: $0

Dividends: $568

Capital: $80,000

SBRA dividend: $300

OHI dividend: $268

Total cash flow for November 2021: $568 - 0.7%

Cumulative for year 2021: $5,968 - 7.5%

January 2022

Stocks: $1215

Options: $0

Dividends: $0

Capital: $80,000

Total cash flow for January 2022: $1215 - 1.5%

Cumulative for year 2022: $1215 - 1.5%

February 2022

Stocks: $0

Options: $0

Dividends: $434

Capital: $80,000

Total cash flow for January 2022: $434 - 0.5%

Cumulative for year 2022: 1649 - 2%

No trades or dividends

April 2022

Stocks: $0

Options: $0

Dividends: $514

Capital: $80,000

Total cash flow for January 2022: $514 - 0.6%

Cumulative for year 2022: $2163 - 2.7%

May 2022

Stocks: $0

Options: $0

Dividends: $434

Capital: $80,000

Total cash flow for January 2022: $434 - 0.5%

Cumulative for year 2022: $2597 - 3.2%

June 2022

No trades or dividends

July 2022

Stocks: $0

Options: $0

Dividends: $514

Capital: $80,000

Total cash flow for January 2022: $514 - 0.6%

Cumulative for year 2022: $3111 - 3.9%

August 2022

Stocks: $0

Options: $0

Dividends: $434

Capital: $80,000

Total cash flow for January 2022: $434 - 0.5%

Cumulative for year 2022: $3545 - 4.4%

September 2022

No trades or dividends

October 2022

Stocks: $0

Options: $0

Dividends: $514

Capital: $80,000

Total cash flow for January 2022: $514 - 0.6%

Cumulative for year 2022: $4059 - 5.1%

November 2022

Stocks: $0

Options: $0

Dividends: $434

Capital: $80,000

Total cash flow for January 2022: $434 - 0.5%

Cumulative for year 2022: $4493 - 5.6%

Summary: 2022 was the year with markets going down. I didn't make any trades except in January.

The total cash flow for 2022 with dividends only was 5.6%, Compared to 2021 where I did some trading in addition to the dividends it was less: 5.6% in 2022 versus 7.5% in 2021 (July-December only).

Without doing any trades, getting dividends only, I get 5.6% per year. For now I will just wait till markets stabilize. If I will do any more trades, I will add below.