Our family likes to go on cruises with Royal Caribbean.

They cruises are expensive but enjoyable.

Recently I found something new to me: Royal Caribbean will give you a statement credit if you own their stock.

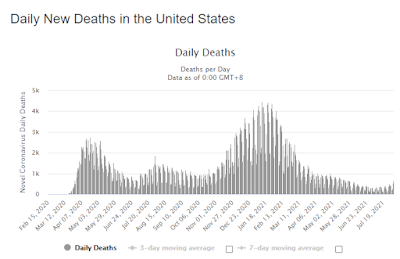

At this time, after they were hit by Corona, their stock is still relatively low and I decided to look into it, to see if I can do anything with that.

Here is the link to the official site with the complete information to stockholder benefits.

The summary for RCL shareholders as of July 2021:

1. Any shareholder of a minimum of 100 RCL shares at the time of sailing can get $250 onboard credit per Stateroom of 14 or more nights, $100 credit for 6-13 nights and $50 credit for 5 night or less.

2. The credit is per room, not per person.

3. Check the eligibility when booking (applicable on any eligible Royal Caribbean or Celebrity Cruises, excluding carters and Galapagos sailings).

4. Two-three weeks prior to sail date you can mail, fax or email the proof that you own RCL shares with the current brokerage statement or a current trade confirmation along with your sailing date, name of vessel and reservation/booking number. Email to shareholderbenefit@rccl.com. You can complete your Shareholder Onboard Credit Offer Request electronically here.

5. Only one shareholder credit per stateroom on any one sailing, based on double occupancy. one shareholder credit per stateroom, and one credit per shareholder per sailing.

6. you may request this benefit multiple times-as often as you sail on Royal Caribbean International or Celebrity Cruises.

7. Onboard credit may not be used for onboard service charges or pre-purchased activities. Any unused credit after the final night of the sailing shall be forfeited and is not redeemable for cash.

With questions you can call the Shareholder Benefit Team: (954) 628-9325, option #3.

What can I do to get more than that?

My thoughts were:

Option 1:

I can buy RCL shares (current price $85.51 at the time of writing/thinking) and hold them. I will get the statement credit when I book and I will get the dividends for holding the stock.

Option 2:

I can use options and not own the stock outright. In case the options will be executed, I am OK with owning the stock. I might get more that way.

I decided to go with Option 2.

The stock price is still low. The dividends are $0.78 per stock per quarter, that will be $312 per year if you own 100 shares (before taxes).

If I buy and hold 10 RCL I will have $312 in dividends (before tax) and get statement credit if I go on the cruise (probably $100 since we usually go for 7 days).

If I have luck and the options play goes well, I could pay the entire trip with the option play proceeds.

We are not planning the trip for 2021 or 2022, I will wait till all Corona related rules and restrictions settle.

So I have about 2 years for the play.

Our trip is about $6,000-7,000 when we book. That should be at least $10,000 in option proceeds before taxes.

So with all that my goal is at least $10,000 in the timeframe of 2 years.

I am allocating approximately $24,000 to that play. The return in 2 years should be about 40% or 20% each year of play. This is quite a bit, it will probably be difficult to reach.

RCL OPTIONS PLAY

Start: June 2021

Finish: still ongoing

Updates: monthly

UPDATES

June 2021

I sold 3 puts on June 22nd for the credit of $411 after fees (-3Jul21 $80 put).

I made $411 for this trade and it will be about $250-300 after taxes. This is already more than the stateroom credit for owning $100 shares. But I sold 3 puts which was equivalent of 300 shares.

-3Jul21 $80 put - this trade:$411 - total:$411 - percent this trade 1.7% - percent total- 1.7%

July 2021

The puts were executed on July 19. I own 300 RCLs.

August 2021

I sold 3 calls against the 300 RCL shares on August 4 (-3Sep21 $80 call). It is a covered call and if the share price will be $80 or above, the options will be executed. I will make nothing on the shares, since I got them for $80, but for the selling 3 call options I got credit of $709.

Total so far: $1,120 (4.6% return on $24,000)

-3Jul21 $80put - this trade:$411 - total:$411 - percent this trade 1.7% - percent total 1.7%

-3Sep21 $80call (covered) - this trade:$709 - total:$1,120 - percent this trade 3.0% - percent total 4.6%

September 2021

The September covered calls were executed and the 300 of RCL were sold at $80. Currently the stock is at $82. I sold 3 October $83 puts for $990. Capital in play now is $24,900.

-3Jul21 $80put - this trade:$411 - total:$411 - percent this trade 1.7% - percent total 1.7%

-3Sep21 $80call (covered) - this trade:$709 - total:$1,120 - percent this trade 3.0% - percent total 4.6%

-3Oct21 $83put - this trade: $990 - total so far $2,110 - percent this trade 4% - percent total so far 8.8%

October 2021

Sold naked puts for 35 days till expiration: 3 November $82 puts for $730. Capital in play is $24,600.

-3Jul21 $80put - this trade:$411 - total:$411 - percent this trade 1.7% - percent total 1.7%

-3Sep21 $80call (covered) - this trade:$709 - total:$1,120 - percent this trade 3.0% - percent total 4.6%

-3Oct21 $83put - this trade: $990 - total so far $2,110 - percent this trade 4% - percent total so far 8.8%

-3Nov21 $82put - this trade: $730 - total so far $2,840 - percent this trade 3% - percent total so far 11.5%

November 2021

Puts got executed, now I own 300 shares at $82.

Capital in play is $24,600.

-3Jul21 $80put - this trade:$411 - total:$411 - percent this trade 1.7% - percent total 1.7%

-3Sep21 $80call (covered) - this trade:$709 - total:$1,120 - percent this trade 3.0% - percent total 4.6%

-3Oct21 $83put - this trade: $990 - total so far $2,110 - percent this trade 4% - percent total so far 8.8%

-3Nov21 $82put - this trade: $730 - total so far $2,840 - percent this trade 3% - percent total so far 11.5%

December 2021

No trades or dividends

Total for 2021 (June - December) - $2,840 (11.5%).

January 2022

Sold calls and now have 3 covered calls and 300 shares (-3 RCL Feb22 at $85) for $1140. Capital in play is $24,600.

-3Jul21 $80put - this trade:$411 - total:$411 - percent this trade 1.7% - percent total 1.7%

-3Sep21 $80call (covered) - this trade:$709 - total:$1,120 - percent this trade 3.0% - percent total 4.6%

-3Oct21 $83put - this trade: $990 - total so far $2,110 - percent this trade 4% - percent total so far 8.8%

-3Nov21 $82put - this trade: $730 - total so far $2,840 - percent this trade 3% - percent total so far 11.5%

-3Feb22 $85call (covered) - this trade: $1,140, total so far $3,980 - percent this trade 4.6%, total percent 16.2%

February 2022

Sold stocks, received $450.

Capital in play is $24,600.

Total so far: $4,430

March 2022

Sold calls and now have 3 covered calls and 300 shares for $1907.

Capital in play is $24,600.

Total so far: $6,337

March 2022 - April 2023

During this time the market was going down. I had no trades. I will wait till market stabilizes and continue my way to get $10,000 for the next trip. I already have $6,337 and still need $3,663.

May 2023

Sold 3 covered calls for $406 (-3 RCL Jun23 at $77.5).

Capital in play is $24,600.

-3Jun23 $77.5 call (covered) - this trade: $406, total so far $6,743 - percent this trade 1.65%, total cumulative percent since start 27.5%

Total so far: $6,743

June 2023

Sold stock for $204

Capital in play is $24,600.

Total so far: $6,947

Pending update